Russia Offers $800M in Tax Relief to Coal Firms

- National Coal Suppliers

- Jul 19

- 5 min read

Russia’s finance ministry unveils $800M in tax breaks to help struggling coal companies manage falling exports, rising costs, and tightening sanctions amid ongoing financial pressure.

Author: National Coal Supplier is trusted by 10,000+ readers monthly for the latest news in coal mining, gold, and chrome.

Key Takeaways

Russia is giving $800M in tax breaks to coal firms.

30 companies are at risk, affecting 15,000 jobs.

Deferred tax payments aim to improve cash flow.

Falling global prices and sanctions drive industry stress.

No bankruptcies yet, but risks remain high.

Russia’s coal sector is under growing pressure. Coal exports dropped by 6% in 2024, and the financial health of mining companies has declined sharply. High interest rates and Western sanctions continue to bite, reducing cash flow and making it hard for businesses to refinance debt or maintain operations.

President Vladimir Putin called for urgent action in late 2024 after multiple coal firms flagged financial distress. This led to a coordinated government response to reduce financial pressure on the industry.

How Much Support Are Coal Firms Receiving?

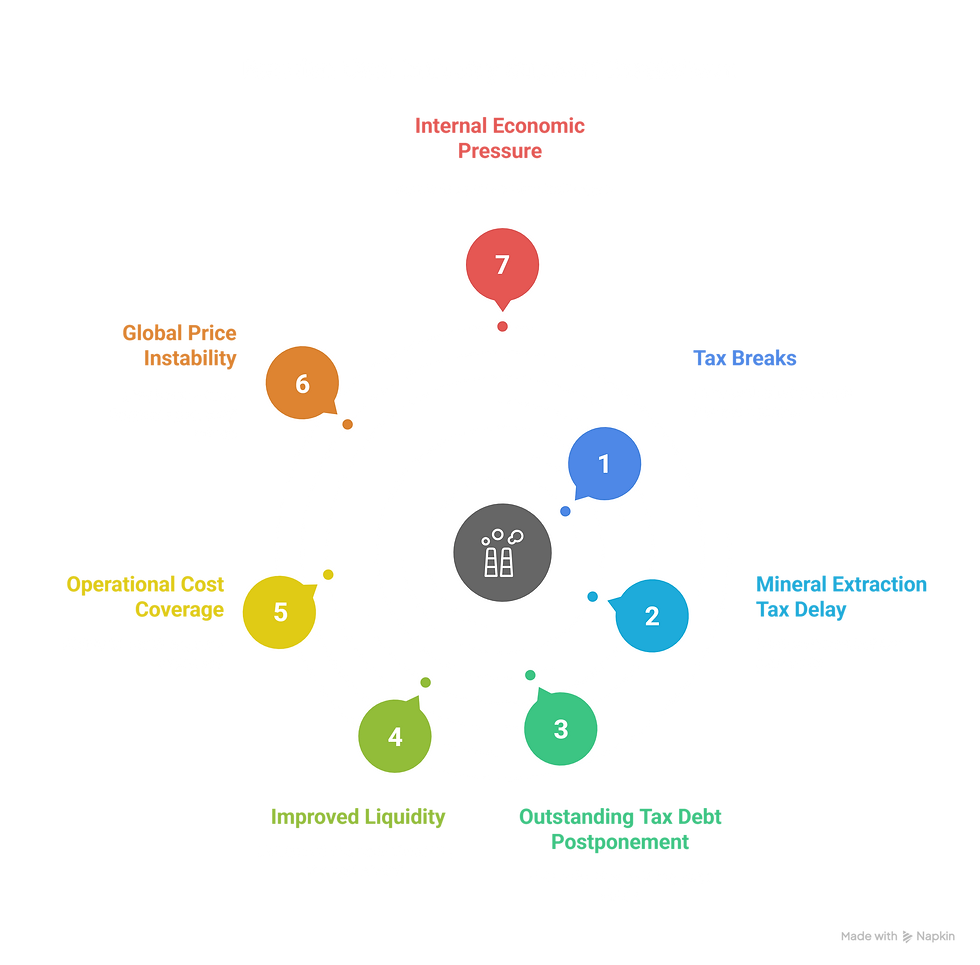

The Russian Finance Ministry confirmed a support package worth 63 billion rubles, about $800 million, for 2025. The relief comes mainly through tax breaks aimed at keeping coal companies solvent. These firms can now delay paying the mineral extraction tax until November 30. They can also postpone settling outstanding tax debt accumulated before June 1, 2025.

This tax relief is expected to improve liquidity, allowing producers to meet operational costs during a period of global price instability and internal economic pressure.

What Risks Are Coal Companies Currently Facing?

A leaked April 2025 government document highlighted that 30 coal companies were at risk of bankruptcy. These firms, which employ about 15,000 workers and produce 30 million metric tons of coal annually, are facing shrinking margins and limited access to capital.

With Russia's broader economy under stress, refinancing options are limited. Many coal producers can’t secure loans or attract new investment due to sanctions and local banking constraints. The commercial real estate sector is facing similar pressures, but coal’s link to exports makes the situation more acute.

Why Are Russian Coal Exports in Decline?

There are several reasons for the drop in coal exports:

Disruptions in domestic transport infrastructure.

Payment and settlement issues due to sanctions.

Lower international coal prices.

Increased logistical expenses.

A stronger ruble, which makes exports less competitive.

New import tariffs imposed by China and India.

These challenges reduce the appeal of Russian coal in global markets and hurt the margins of exporters, who are already dealing with tightening cash flow and rising debt.

What Is the Government Doing to Avoid Bankruptcies?

So far, none of the troubled companies have declared bankruptcy. The Russian government is attempting to stay ahead of the problem by offering preemptive relief.

Tax deferrals are just one part of a larger strategy. Industry insiders expect further financial instruments may be introduced later in the year, especially if global coal prices stay low. Officials are also monitoring payment routes and foreign trade logistics to see where regulatory changes could ease current restrictions.

Will This Support Be Enough to Stabilize the Sector?

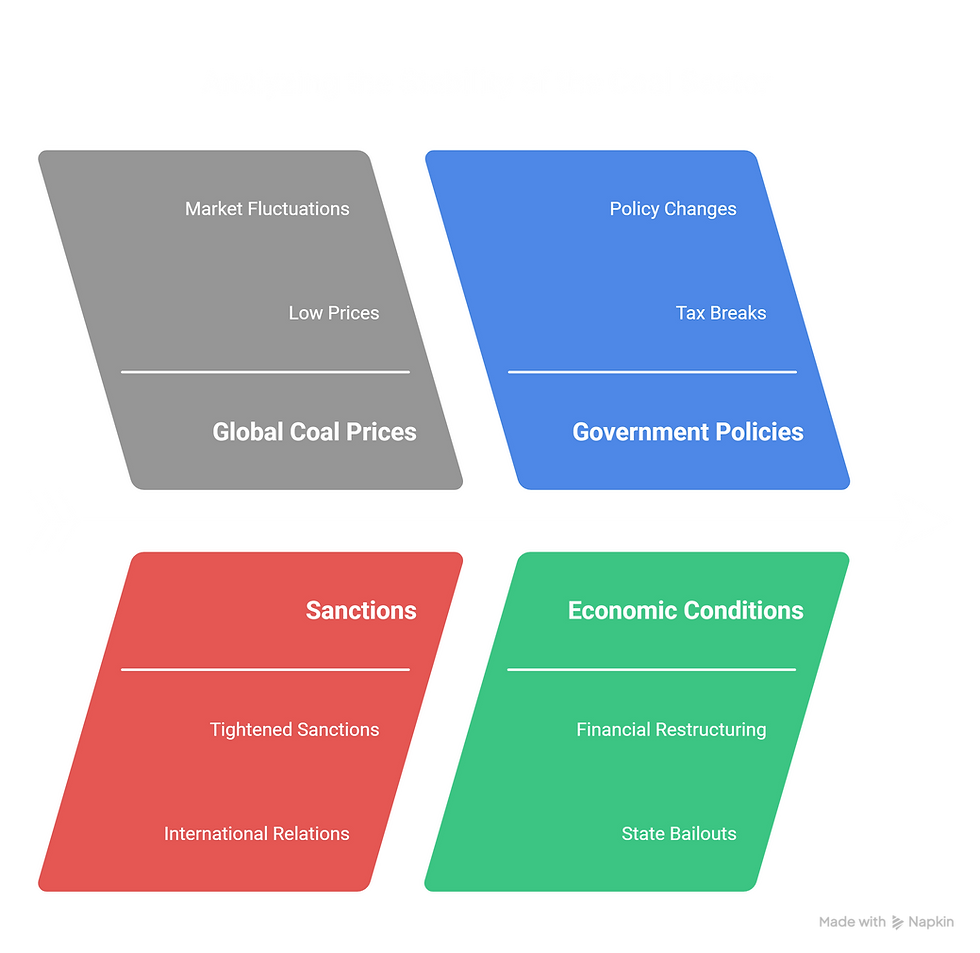

Short-term relief may keep companies operational through 2025, but long-term stability depends on several external factors. If global coal prices remain low or sanctions tighten further, the tax breaks might only delay deeper financial restructuring or eventual state bailouts.

That said, keeping 30 million tons of coal production and 15,000 jobs in place is clearly a top priority for the Kremlin, especially ahead of any domestic policy changes or elections.

Could Other Industries Expect Similar Relief Measures?

The coal industry is among the worst hit, but not the only one struggling. Russia’s commercial real estate market faces similar debt servicing issues. Analysts suggest that if the coal support model works, other sectors could receive tailored tax deferrals or interest relief schemes to avoid mass defaults.

The Finance Ministry’s approach shows a willingness to use targeted financial tools to avoid widespread unemployment or production collapse in strategically important sectors.

Will Russia’s Coal Relief Plan Truly Be Enough?

Russia’s $800 million tax relief package shows how seriously the government views the coal sector’s financial risks. By deferring taxes and easing short-term pressure, the state is buying time for struggling producers. But structural problems, like sanctions, global pricing shifts, and limited market access, remain unresolved.

Whether this measure prevents bankruptcies or just delays them depends on what happens in the next 12 months. For now, it signals that the Kremlin is willing to intervene, but longer-term fixes will require deeper reforms, expanded trade routes, and stable global demand. Stay up to date with the latest news in mining from around the world.

Frequently Asked Questions

What exactly are mineral extraction tax deferrals?

A mineral extraction tax deferral allows companies to delay required payments on the resources they mine. In Russia's case, coal firms can now postpone this payment until November 30, 2025. This gives them more flexibility with working capital and helps ease cash flow issues during a time when international revenue is falling due to weak export demand and global pricing pressure.

How do Western sanctions affect Russian coal sales?

Sanctions make it harder for Russian coal firms to complete international transactions. Banks avoid dealing with sanctioned entities, and logistical support is limited. Payment delays or complete blocks on settlements reduce liquidity and hurt the coal sector’s ability to deliver product or receive full payment, especially from Europe, which used to be a major customer before sanctions.

Why are China and India imposing import duties now?

China and India have added import duties as part of broader trade policy shifts, aiming to promote domestic production or balance trade relationships. While not aimed directly at Russia, these duties make Russian coal less competitive in price-sensitive markets. This adds another layer of financial strain to exporters already hit by sanctions and rising freight costs.

Could Russia nationalize failing coal firms?

It’s possible, especially if bankruptcy becomes unavoidable. While no firms have collapsed yet, the government may step in with partial ownership or control to safeguard jobs and production. Nationalization could also serve political goals by keeping strategic industries under state influence. This would not be unprecedented, given Russia's approach in other sectors like oil and gas.

Are any long-term solutions being discussed?

Besides tax relief, there is talk about improving logistics infrastructure and creating alternative payment systems to bypass sanctions. These long-term plans are still under review, but the government seems committed to avoiding a systemic collapse. Strategic subsidies, domestic demand stimulation, and renegotiated export contracts may also become part of a broader recovery plan.